Business Restructuring & Workouts

Often times, small businesses encounter difficulties during the normal course of development. Fundamental to long-term success is the ability to identify potential problems before the viability of the enterprise is jeopardized. For small business owners, this means they must examine their own decision making on an objective basis.

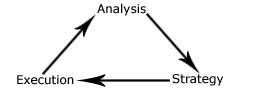

To effectively restructure a business it is imperative that management focuses on three major tasks. First, a management team must be willing to objectively analyze the current condition of the business. Second, the management team must draft a formal plan for the restructuring of the operation. Finally, the management team must be able to execute day to day operations effectively.

Analysis of Current Business Conditions

As an outside observer, Key Consulting, Inc. can take an objective look at the existing business strategy, and analyze the overall business condition. Without the bias of outside forces, we can help to identify some of the specific problems facing an operation. The scope of such analysis may vary, but will include examination of:

- Competitive Position – Does the company offer a competitive product in the market? Can the company effectively compete in the industry? Has the company permanently damaged relations with crucial customers? Does the company possess specific products that provide an edge in the market?

- State of Relations With Critical Stakeholders – Are key managers and employees seeking an exit from the company? Are major customers using competitors for their business needs? Are lenders or outside agencies preparing legal action? Are critical vendors shipping necessary goods and services?

- Financial Condition - What is the state of the financial structure? Do coherent financial controls exist? What is the state of relations with equity investors and lenders? Is working capital managed in an effective manner? Are revenues declining so rapidly that a restructuring is impossible?

Developing a Strategic Plan

After an analysis of the current business position has been completed, the next step is to draft a strategic plan for getting the business on a path to prosperity. Working closely with critical stakeholders, a formal restructuring plan is drafted. The content of a restructuring plan will vary based upon the size and complexity of the business. Common elements include:

- A Financial Plan or Operating Budget – Designed to put key creditors at ease regarding repayment. Contains debt repayment data, cash flow projections, profit and loss projections, and financial targets.

- Development of Financial Controls – Policy regarding the management of working capital, frequency of financial reporting, allocation of financial resources, and assignment of specific areas of responsibility.

- Operational Improvements – Cost reduction targets, sales and marketing goals, employment levels, fixed asset matters, increasing operational efficiencies, and management team building.

- Improving Relations With Critical Stakeholders- Establishment of regular meetings with lenders, employees, customers and vendors. Designed to help the business regain credibility in the market.

Executing a Strategic Plan

With a formal strategic plan in place, execution of the plan becomes the final element in an effective restructuring effort. To properly execute, an enterprise must:

- Attract and retain skilled managers and employees

- Assign specific areas of responsibility

- Establish regular performance reviews

- Review and revise goals and objectives

Defining Ownership Goals

As a restructuring evolves, ownership must assess their intermediate and long-term goals for the operation. Based upon a variety of factors, owners may consider:

- Selling the business as an ongoing entity

- Selling specific assets or product lines

- Continuing operations as a restructured entity

- Closure or liquidation

|